Multi-Channel Marketing for Banking

Today we are going to dwell upon the peculiarities of omnichannel marketing and consider the main tasks it can solve in banking sphere. For a start here are some facts. Multi-channel marketing can be characterized as a mode of interaction with your audience by means of several communications channels (web site, email and SMS marketing, push etc.). This kind of marketing gives us an opportunity to build strong relations with customers thanks to deep needs and preferences analysis. in this respect CRM passed into the background. we by no means ask you to turn your back on CRM, it’s irreplaceable. But all the same a CRM system doesn’t meet the requirements of customers in the banking field to the full extent. There’s a need to use a platform or a service that can unite several communication channels. Besides, CRM can’t track delivery and handling of customers’ complaint. It leads to worse deliverability and you can be added to spam. You also need to store information about deliver, message statuses etc. SMS sending requires several sms-gateways integration. These cumbersome systems don’t do much good. There is no CRM system that has the same segmentation and analytics capabilities as a multi-channel marketing platform, which technically substitutes dozens of integrations.

CRM stores a lot of confidential information. When interacting with external systems there’s a high leakage risk. Dealing with multi-channel platform Altcraft there is only one point of interaction with external systems and it is located behind the bank’s firewall. That helps to control personal data safety and reduce a risk of mistakes that can be made by a bank employee.

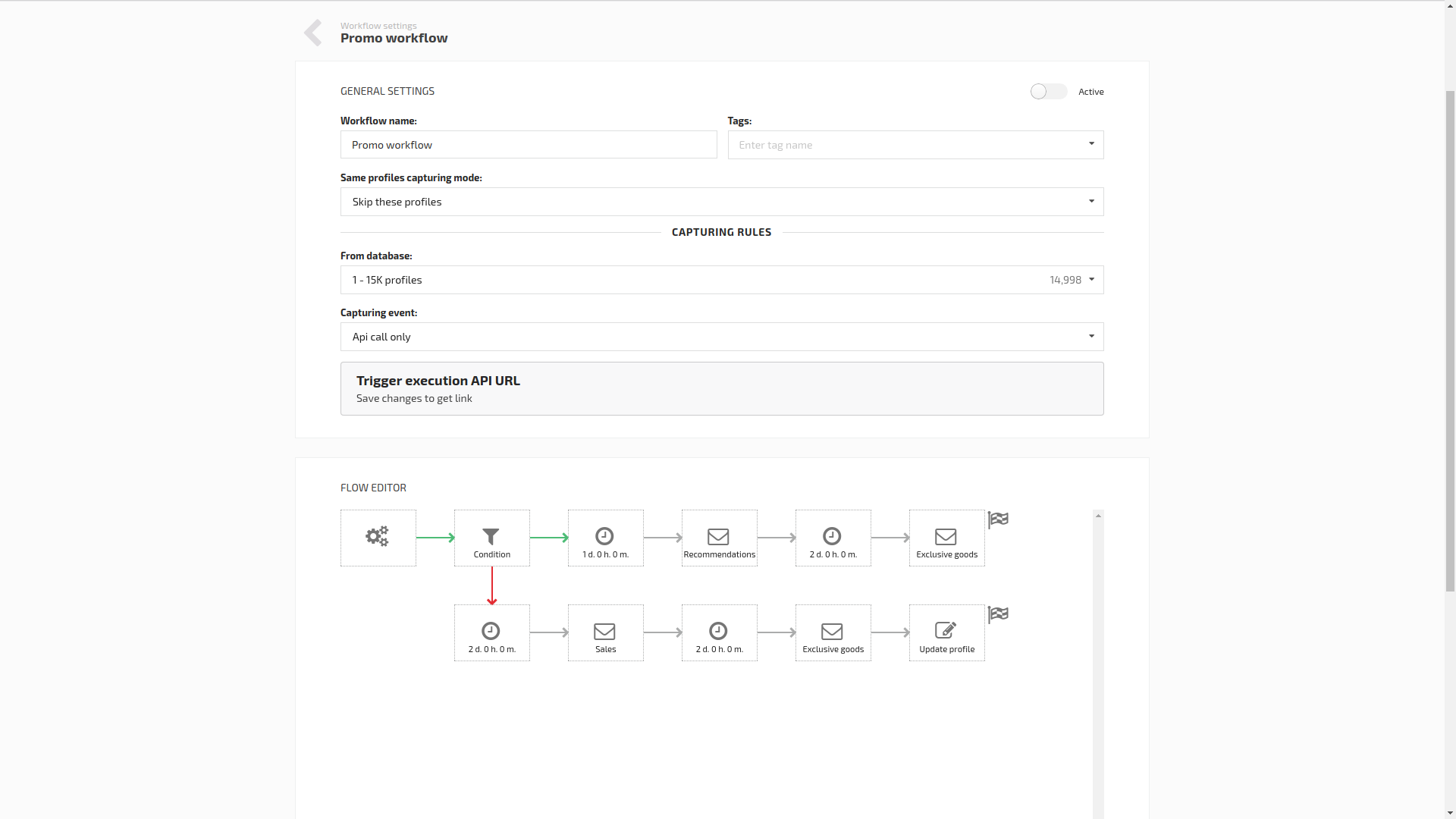

1. Marketing processes automation

Automation of certain marketing processes enables you to systematize Email, SMS, Push more easily. At this point the integration is performed between bank and partners’ websites on the one hand and multi-channel platform on the other, CRM integration, senders and sms-gateway settings and other product that are used by a bank.

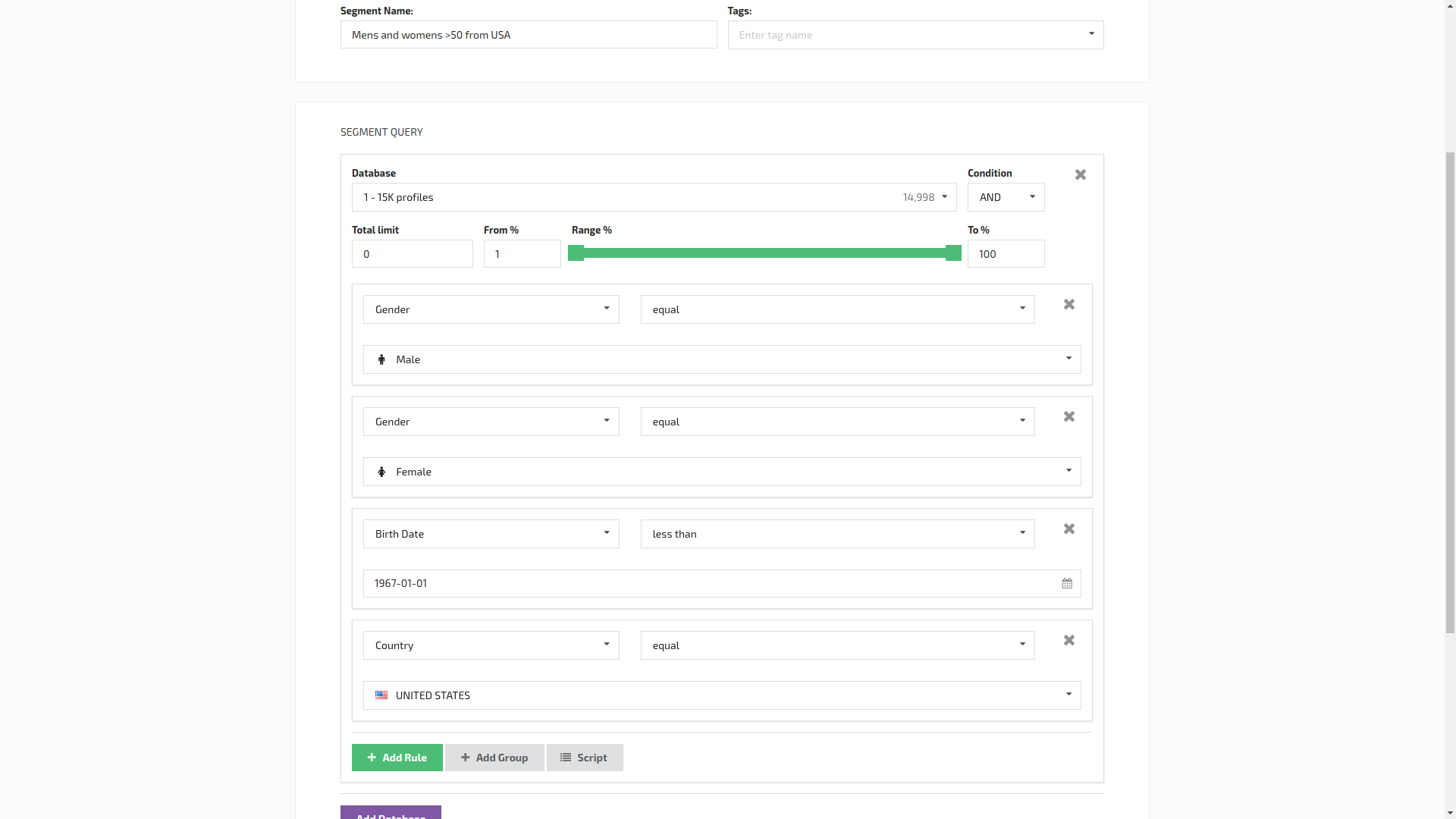

2. Understanding and analysing your clients’ interests and preferences

Customer base is the most valuable asset for any company. Creation of a digital profile and accumulation of information about customers’ preferences becomes a strategic goal for any bank. If you plan communication with a customer thoroughly it’s easy to keep their interest in your product. We’ve marked out the main types of customer data that can help to segment and plan your future marketing strategy:

| Demografic | Geografic | Psychographic | Behavioural | Consumer-oriented |

|---|---|---|---|---|

| Gender, age, marriage status, family size, education, occupation, income level | Place of residence: country, region, city/town, nationality | Personal attributes, values, opinions, interests | Attitude to the product, demanded services, ignored services, the importance of price changing, the importance of quality | Loans, saving and check accounts, bank card services, trust services, person or company |

Analysis of the gathered data helps to identify:

- how your bank is treated by customers;

- what kind of services they are looking for;

- what trends are important for customers;

- and whether they have unsatisfied needs.

Based on received data one can plan marketing strategy. Without drawing customers into a real conversation there would be no interest or wish to continue communication. Three main tools which help to be in touch with your customers are Email, Push and SMS.

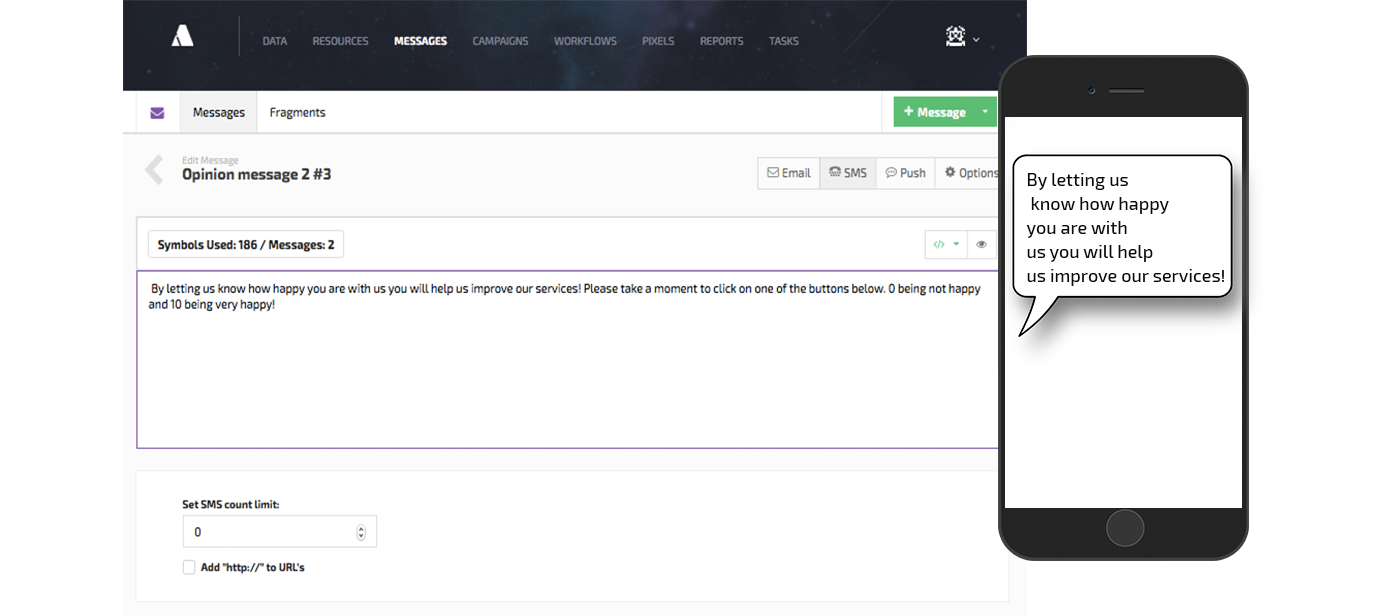

3. Prompt notifications

Prompt notifications prove your care for customers and indicates your service quality. Inform them about coming obligatory payments, their financial flows, in and out payments, credit card expiration and its re-issuing. Send them emails with credit card account statements.

4. Demand and sales promotion

Audience analysis made by the bank let customers receive:

- relevant bank services advertising,

- information about new products,

- information about discounts and campaigns,

- Individual offers and useful recommendations.

As a result a customer learns in time about new bank services, special offers, credits and deposits.

5. Retain old customers and win back lapsed customers

- National and personal holidays greetings, special offers (for example, for customers who haven’t used bank services for 6 months).

- Reminder-letters about bank products and services.

Besides it is necessary to handle feedback. It gives an opportunity to respond in real time to customers’ opt- out and change your communication line with them. It also helps to close a possible gap in service.

To conclude

Banks should take care of their clients. It’s an easy thing with a multi-channel platform.

Altcraft Marketing Platform is just the one that is simple and handy.

You might be interested in:

Uncover email marketing secrets, avoid common mistakes, and optimize your strategy for maximum impact and conversions.

Read moreWhy people unsubscribe from email newsletters and how to win back email subscribers.

Read moreHow to detect unauthorized access to information and what should be done in this case?

Read more